Borrowing costs jump and pound falls on Chancellor's tears

Getty Images

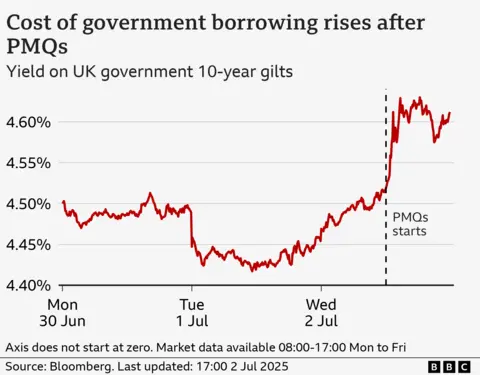

Getty ImagesBorrowing costs have surged and the pound has fallen after a tearful appearance by Chancellor Rachel Reeves in parliament.

Reeves was at Prime Minister's Questions on Wednesday following the government's U-turn on plans to cut billions of pounds through welfare reforms.

Markets reacted after her emotional state sparked speculation about her position in government.

Sterling dropped by 1% against the dollar, ending the pound's strong run against a weaker US currency.

Borrowing costs also soared in one of the biggest single-day moves since October 2022 when markets were in turmoil after former Prime Minister Liz Truss's mini-budget, which eventually led to her downfall.

The rise eased slightly after Number 10 tried to quell rumours that Reeves might be replaced, though it then increased again.

"The chancellor is going nowhere, she has the prime minister's full backing", a government spokesperson said, though Prime Minister Sir Keir Starmer himself declined to give her a public show of support.

However, later on Wednesday he told BBC Radio 4's Political Thinking with Nick Robinson he worked "in lockstep" with Reeves and she was "doing an excellent job as chancellor".

A Treasury spokesperson said the chancellor was upset due to a "personal matter".

The reversal of welfare reforms puts an almost £5bn black hole in Reeves's financial plans.

The rise was initially caused by the suggestion the chancellor might step down, suggesting she retains market credibility.

"The conclusion from financial market price action this afternoon is that the market actually likes Reeves, because UK borrowing costs have jumped and the pound has weakened sharply," said Mike Riddell, fixed income portfolio manager at Fidelity International.

"Of course it may not be about Reeves specifically," he added. "But the market is pricing in uncertainty regarding a potential change in future policy."

The fact that borrowing costs remained higher imply wider concerns about the government's Budget maths are starting to materialise.

Analysts at Rabobank said "investors will be asking how Reeves will balance the books".

They added that "the prospect of more taxation does appear to be a natural conclusion ahead of the Autumn Budget".

Cabinet minister Pat McFadden said on Wednesday that the government would stick to its election pledge not to increase income tax, VAT or employees' National Insurance Contributions.

But he conceded that there would be "financial consequences" to the decision to row back on planned cuts to disability and health-related benefits.

Simon Blundel, head of European fundamental fixed income investments at BlackRock, said the rise in borrowing costs "would suggest more uncertainty with regards to the current government".

But he added that the market was "not as vulnerable as it was in 2022" in the aftermath of the mini-budget.

The FTSE 250, which is more exposed to UK policies than the FTSE 100, closed down 1.34%.