Falling petrol prices push UK inflation down

Getty Images

Getty ImagesFalling petrol prices drove UK inflation down by more than expected in the year to March.

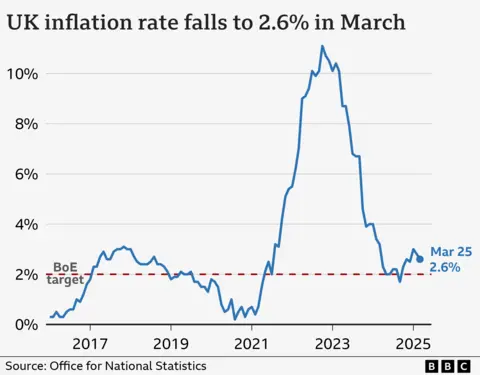

Inflation was 2.6%, down from a rate of 2.8% in February, according to official data.

But the fall may only be temporary as analysts say it's expected to spike from April as rising bills and higher business costs take hold.

"The only significant offset came from the price of clothes which rose strongly this month," said Grant Fitzner, chief economist at the Office for National Statistics (ONS).

The average price of petrol fell by 1.6p per litre between February and March to 137.5p per litre.

The inflation decrease was also driven by a drop in recreation and culture prices, with toys, games, and hobbies falling particularly sharply.

The fall in inflation means that, although prices continue to rise, the pace is slowing. Price rises have slowed from highs seen in recent years.

Wages continue to outpace inflation with salary raises for public sector workers growing more than those in the private sector.

The average rise in wages was 5.9%, data released by the ONS on Tuesday showed.

In May, the inflation figure for April will likely be pushed to around 3% due to increases in gas prices, electricity prices, and water charges, said Michael Saunders, senior advisor at Oxford Economics.

The former member of the Bank of England's interest rate setting Monetary Policy Committee told Radio 4's Today Programme the effect of Trump's trade wars will also be felt in exports and investment in the UK.

"We may get a diversion of cheap exports which might have otherwise gone to the US, will start to come to Europe and the UK," he said.

"Perhaps not as high as the Bank of England had feared a few months ago, but the economy will be weaker, with exports and investment and consumer spending all hit and unemployment starting to rise".

He added that another side-effect of Trump's trade war is hitting global growth, which causes oil prices to fall, which will feed through to lower petrol prices here in the UK.

'It's getting higher and higher'

Sonja Skelton says the biggest cost for her business is staffing - and that's about to get higher with minimum wage increases.

The recent increase in National Insurance has cost her over £60,000.

"And it's getting higher and higher," she says, but she adds she's happy to pay as she says it will help to improve the UK's infrastructure.

Her firm, West Special Fasteners, makes nuts and bolts, and has been doing since 1999.

The firm has over 65 employees and supplies offshore defence and specialist construction firms with non-standard fasteners, made with stainless steel and exotic metals.

"We're trying to be a little bit more efficient, so we're trying to improve all our processes, because that can help claw some of that money back."

But, she adds, if she isn't able to absorb extra costs, the prices of her products will have to go up.

"So there's a specialist material we call that's called Hastelloy C-276. I'd probably say around five years ago, that might have been, say, £30 per kilo.

"We're now looking at around about £50 per kilo. So, as you can tell, it's a massive, massive increase".

As her firm is a high energy user, the rising cost of energy has also "really impacted" her.

On top of that, she says that working in engineering, "you always have ups and downs, because it really depends what's happening all over the world, and conflicts can have a knock-on effect on what we do".

Interest rate cut

As inflation comes down, it could put pressure on the Bank of England to cut its key interest rate, currently 4.5%.

Vacancies at their lowest point in four years and economic pressure predicted from Donald Trump's tariffs may also encourage the Bank to cut when it meets next month.

But the Bank faces a dilemma, as wage growth remains strong and this would normally discourage a cut in rates.

Experts and analysts predict inflation to fall to near its 2% target by 2026.

The drop in inflation will be welcome news to the government, said Lindsay James, investment strategist at Quilter.

"With the jobs market weakening somewhat, and very real and present tariff threats still in play, any downward pressure on inflation will be hailed," she said.

She added the forecast for inflation "remains very uncertain" because of a "volatile" global economy, and rising National Insurance which she said will raise prices from April onwards.

Chancellor Rachel Reeves said the drop was "encouraging" but that "there is more to be done.

"I know many families are still struggling with the cost of living and this is an anxious time because of a changing world," she said.

However, shadow chancellor Mel Stride says Reeves' "reckless union payouts, tax hikes and borrowing binge is driving up the cost of living".

He said inflation remains above the official target of 2% due to her choices.

Liberal Democrat Treasury spokesperson Daisy Cooper said "those already struggling with the sky-high cost of living simply won't be able to withstand another hammer blow to their pockets, such as from President Trump's global trade war".

She urged the government to make trade deals with European and Commonwealth allies.

Additional reporting by Adam Woods.