'My credit score has been destroyed by fake energy debt'

BBC

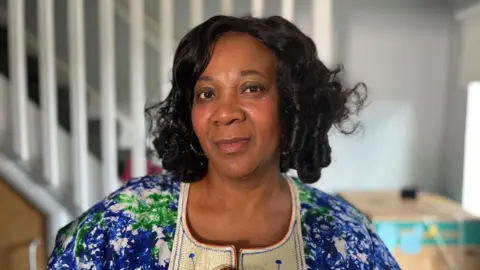

BBCA woman who had a prepayment meter forcibly installed in her home over a debt she did not owe says her credit score is still ruined years later.

Favour Asante – a church pastor – spent years battling with Scottish Power over a non-existent debt before the company apologised and wiped the remaining balance last year.

However, Favour says her credit score is still ruined due to the false debt and she remains unable to get a credit card or take out a phone contract.

Scottish Power said it had removed the credit markers against Favour's record last year but she is concerned her score could take years to recover.

The energy firm said: "We've shared with credit reference agencies that she has a prepayment meter with a zero balance, which should have a positive impact on her credit score."

The error began when Scottish Power wrongly believed she owed them more than £2,000, which eventually led to the firm forcibly installing a prepayment meter into her Glasgow home in late 2022, while she was out of the country visiting family.

It was later discovered that the false debt had arisen because Scottish Power had wrongly opened and closed multiple accounts in her name.

The company has since recognised the mistakes, apologised and wiped the debt.

But Favour said she remains unable to take out a loan, phone contract or get a credit card because of the default on her account.

Getty Images

Getty ImagesIt comes as thousands of energy customers are set to receive payouts, and could see debts written off, in response to widespread controversy over the force-fitting of prepayment meters into people's homes.

The announcement last month followed a review by the energy regulator Ofgem, and could see eligible customers receiving payments starting at £40 and rising up to £1,000.

For years, energy companies were allowed to force-fit prepayment meters into people's homes when bills went unpaid but a scandal erupted during the energy cost crisis of 2022 when suppliers were found to have forced the meters on vulnerable customers.

After intense criticism, Ofgem introduced a moratorium on forced installations in 2023 but allowed companies to restart the practice less than a year later – albeit with stricter rules in place to protect vulnerable households.

But customers who have been affected by the practice of force-fitting prepayment meters over the years have told BBC Scotland News that the compensation payments do not compare with how heavily their lives were impacted.

Favour told the BBC: "It's really affected me emotionally, financially, and it's also ruined my credit score because a bill that wasn't mine was forced into my name and given to the credit agencies.

"For the last six years I have been on the list for not getting any credit from anywhere due to that.

"My credit score has been ruined, I can't apply for anything at the moment. What I've been through compared with £1,000 is not enough."

Favour said she no longer trusts energy companies after the ordeal.

'No compassion'

The review from Ofgem into this practice had an assessment period of 1 January 2022 to 31 January 2023, meaning Favour could be eligible for compensation. But many other customers may not be.

Rebekah has epilepsy and asthma and says that a long-running disagreement with her energy company at the time had a severe impact on her health.

The 34-year-old nursing student told the BBC she was so distressed by having a prepayment meter forcibly installed into her home that she had multiple seizures which resulted in hospitalisation.

Rebekah, who lived in a one-bedroom council flat in Fife at the time, says her then-energy supplier Npower increased her monthly bills from £60 a month in 2014 to about £200 - and said she had a debt of about £1,500.

She disputed this which led to a row that would continue for another three years.

Rebekah claims that a wiring issue with her storage heating meant that it was turning on when it shouldn't have been, including when she was at work.

When she called Npower to ask them to assess the issue the company was "really forceful and harassing" and "threatening with bailiffs".

"They had no compassion or consideration that there was clearly a huge issue for a one-bedroom flat," she said.

Rebekah said several appointments were made for the firm to visit and investigate an issue with the heating, but nobody showed up.

'It was torture'

Then, in 2017, she returned home from work to find that her flat had been broken into and a prepayment meter installed.

"They couldn't attend to check my meter but they could attend to force entry into my house," she said.

"I was having a lot of seizures at the time because of the stress. It really freaked me out and made me feel so unsafe."

Energy firm E.ON has since acquired Npower and Rebekah says that her debt was finally written off in December 2024 after she applied for a winter heating scheme for vulnerable customers.

But she believes that even if she were to receive compensation, it would not be enough.

"It was a constant battle," she said.

"I had to miss work countless times due to the seizures. I'd end up with horrific injuries.

"And yes, my debt has now been wiped off and I'm grateful for that, but the stress of it was torture."

An E.ON Next spokesperson said: "While this case predates our acquisition of Npower and Rebekah was not an E.ON customer at the time, we are pleased that we have since been able to offer direct support and resolve the issue for her."

Getty Images

Getty ImagesOrganisations such as Citizens Advice Scotland have long-opposed the practice of forced installations even prior to it catching headlines in 2022, and raised particular concerns around safeguards in place for vulnerable customers.

Susan, a 62-year-old cleaner from Hamilton, told the BBC she remains affected to this day by having a prepayment meter forced into her home in 2015.

"I was a single mother, working-part time on minimum wage, and came in from work one day right before Christmas to see an envelope with new keys in it," she said.

"They'd broken in and put a prepayment meter in."

Susan said she had fallen into debt of about £3,500 with energy provider EDF after struggling with the death of her father alongside having a disability and mental health issues.

"I know it was my fault for racking up the debt and I buried my head in the sand, but they never gave me the option to pay it off in instalments at all and I didn't know they'd break in when I wasn't there," she said.

"It was so upsetting because I couldn't talk to anybody about it and I was embarrassed about the debt. I didn't want my family to know."

Susan thinks there are not enough protections in place to support vulnerable customers who find themselves in debt, and says she would have agreed to a repayment plan if she had been made aware it was an option.

She said: "If they'd have told me they were coming, I would have arranged to take time off work so that at least there wouldn't be people in my house when I wasn't there.

"I'm not vulnerable now like I was then, I am doing much better, but there were not measures in place to protect vulnerable people.

"It was just awful. They could see that a kid lived here, that it was Christmas. What a time of year to do that to somebody."

EDF told BBC News that they made multiple attempts to engage with Susan prior to the prepayment meter being installed, but have now decided to clear her remaining debt.

A spokesperson said: "Having reviewed Susan's account, we have assessed that she is eligible for our 'Fresh Start' support scheme, which supports individual customers selected on a case-by-case basis with debt clearance.

"In addition to clearing the remaining debt, we've also agreed an appointment for Susan to upgrade to a smart meter. Prepay meters provide the cheapest standard variable rates, and a smart PAYG meter removes the need to visit a shop to top-up and enable us to provide support quickly if customers run into difficulty."

Distressing cases

As of 2024, Ofgem has introduced rules which means companies cannot force-fit meters if an occupant of the house is over 75 with no other support, is under two years old, needs energy for health reasons, or suffers from a chronic or terminal illness.

Dhara Vyas, chief executive of Energy UK, which represents energy firms, said suppliers had been working closely with Ofgem to meet the regulator's requirements, but said there were instances where forced fittings were appropriate.

Citizens Advice Scotland director of impact David Hilferty said the compensation scheme is welcome news.

He said: "We have always opposed forced installations as they take away people's choice, pushing them to pay money upfront which they often can't afford.

"Our network has seen many distressing cases over the years of people who have been forced to disconnect their heating supply or go into debt as a result of this, so it's right that they should be compensated.

"What's important now is that suppliers deliver this compensation quickly and do the right thing for those who have experienced unnecessary harm."